Don’t forget to add the cost of your consumables to your total manufacturing cost. It is important to understand that the allocation of costs may vary from company to company. What may be a direct labor cost for one company may be an indirect labor cost for another company or even for another department within the same company. If the employee’s work can be directly tied to the product, it is direct labor. If it is tied to the marketing department, it is a sales and administrative expense, and not included in the cost of the product. It's important to note that direct material costs are only a part of the total manufacturing costs when converted into another product.

- Also, if your raw material is tough to process, like diamonds, it might be worth paying more because the process can take so long and require much labor and energy.

- Some examples of direct materials for different industries are shown in Table 4.2.

- But note that while production facility electricity costs are treated as overhead, the organization’s administrative facility electrical costs are not included as overhead costs.

- If your small business engages in manufacturing, you should know three common manufacturing expenses.

- When starting a business, you'll hear much about direct and indirect manufacturing costs.

- Even if management is willing to price the product as a loss leader, they still need to know how much money will be lost on each product.

Manufacturing overhead is any manufacturing cost that is neither direct materials cost nor direct labour cost. Manufacturing overhead includes all charges that provide support to manufacturing. In this example, the total production costs are $900 per month in fixed expenses plus $10 in variable expenses for each widget produced.

The total direct material costs = Beginning Direct Materials + Direct Materials Purchased – Ending Direct Materials.

However, all accounting methods for manufacturing costs ultimately aim to provide information that will help managers make decisions about pricing, production levels, and product mix. A cost accounting system is a system that tracks the costs of all the resources used in the production of a product. The most apparent benefit of activity-based costing is that it provides more accurate cost information. This allows you to allocate costs across different categories of activities. For example, labor, materials, or overhead, and get a better idea of how much each activity contributes to the total cost of production.

Further, a company needs raw materials on hand for future jobs as well as for the current job. The materials are sent to the production department as it is needed for production of the products. In conclusion, it is essential to understand manufacturing costing and how it works to make the best decisions for your company. The benefits of manufacturing costing include a better understanding of your product costs, pricing products more accurately, and making more informed decisions about where to source materials. Manufacturing costs are the expenses a company incurs to create its products.

What's The Difference Between Direct And Indirect Manufacturing Costs

You might be debating whether calculating your total manufacturing cost is even worth the hassle. If you put some time aside and calculate your manufacturing costs, here are five benefits you can expect to reap. Some materials and labor are regarded as indirect manufacturing costs (more on that below). Managers use the information in the manufacturing overhead account to estimate the overhead for the next fiscal period. Do you know of a restaurant that was doing really well until it moved into a larger space?

You make money on each sale if you can sell your product for more than its manufacturing costs. You will lose money on each sale if your manufacturing costs exceed your selling price. Nonetheless, additional production always generates additional manufacturing costs. As the rate of production increases, the company's revenue increases while its fixed costs remain steady.

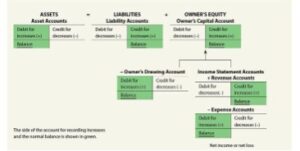

Financial & Managerial Accounting

Product costs are costs that are incurred to create a product that is intended for sale to customers. Product costs include direct material (DM), direct labor (DL), and manufacturing overhead (MOH). Knowing the total manufacturing cost formula can give you insights into where inefficiencies exist. This can help businesses make changes that lead to a more efficient manufacturing process and lower costs.

For example, a small business that manufactures widgets may have fixed monthly costs of $800 for its building and $100 for equipment maintenance. These expenses stay the same regardless of the level of production, so per-item costs are reduced if the business makes more widgets. The opportunity to achieve a lower per-item fixed cost motivates many businesses to continue expanding production up to total capacity. Manufacturing costs, for the most part, are sensitive to changes in production volume.

What are the benefits of using the total manufacturing cost formula?

The direct labor costs for Dinosaur Vinyl to complete Job MAC001 occur in the production and finishing departments. In the production department, two individuals each work one hour at a rate of $15 per hour, including taxes and benefits. The finishing department’s direct labor involves two individuals working one hour each at a rate of $18 per hour. There https://kelleysbookkeeping.com/journal-entries-to-issue-stock/ are several methods for calculating the cost of a product, but the most important factors to consider are direct labor, direct materials, and overhead costs. Finally, it is worth noting that manufacturing costs constantly evolve as new technologies emerge; companies who stay ahead of the curve will be better positioned to compete in the future.

It is much more practical to track how many pounds of nails were used for the period and allocate this cost (along with other costs) to the overhead costs of the finished products. Job order costing requires the assignment of direct materials, direct labor, 3 Common Types Of Manufacturing Costs and overhead to each production unit. The primary focus on costs allows some leeway in recording amounts because the accountant assigns the costs. When jobs are billed on a cost-plus-fee basis, management may be tempted to overcharge the cost of the job.

Advantages & Disadvantages of Manufacturing Overhead Costs

Despite the challenges you may face, by understanding the root causes of these cost overruns, you can take steps to minimize their impact on your business. Fortunately, numerous software programs are available to help manufacturers keep track of their costs, and the most critical factor is finding one that fits their specific needs. These programs range from simple Excel templates to full-fledged enterprise resource planning (ERP) systems.

Similarly, more oversized or complex products will cost more than simpler ones. Finally, products that must meet high-quality standards will usually be more expensive than those that do not. By understanding these factors, businesses can better control the cost of their products. Alternatively, if you find that the average product cost is less than the selling price, you may be able to increase production to increase sales and profits.