Contents

Additionally, as cryptocurrency gains more popularity as a globally recognised digital asset, cryptocurrency CFDs have also started generating lots of interest in the market. CFDs are traded on margin meaning the broker allows investors to borrow money to increase leverage or the size of the position to amply gains. Brokers will Cost Volume Profit Definition & Explanation require traders to maintain specific account balances before they allow this type of transaction. CFDs trade over-the-counter through a network of brokers that organize the market demand and supply for CFDs and make prices accordingly. In other words, CFDs are not traded on major exchanges such as the New York Stock Exchange .

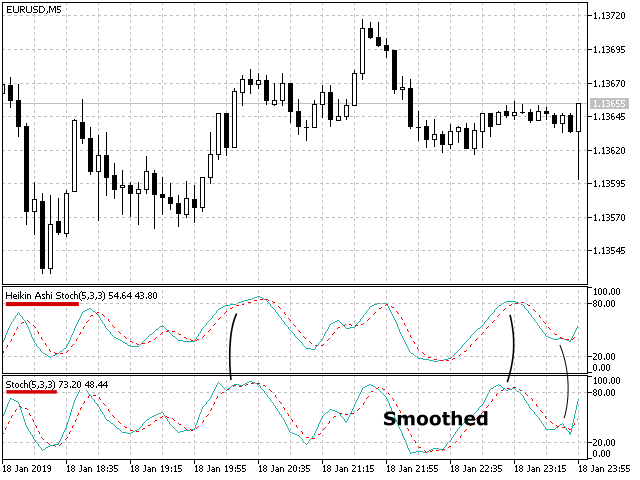

Forex trading is a very popular financial activity – in fact, it is the most liquid market in the world, it operates five days a week with no interruptions and has many different assets to invest in. Forex is the ideal way to diversify your investments, using CFDs to operate efficiently, both long and short, using technical https://1investing.in/ analysis to identify trends and build personalised strategies. Experienced traders use fundamental and technical analysis to gather valuable market information. Learn the types of economic indicators to look for, and how to apply technical indicators to manage your trading strategy and minimize your risk exposure.

CFDs: Which Market to Trade?

This can be anything, from a sudden pandemic, to trade wars, to a company selling their shares, or how the law changes, which hugely influences the GDPs of various countries. A hedge is a type of investment that is intended to reduce the risk of the effect of adverse price movements in an asset. CFDs essentially allow investors to trade the direction of securities over the very short-term and are especially popular in FX and commodities products. I wrote in my previous piece on 6th November that the best trades for the week were likely to be making short-term trades long of the CAD and the NZD.

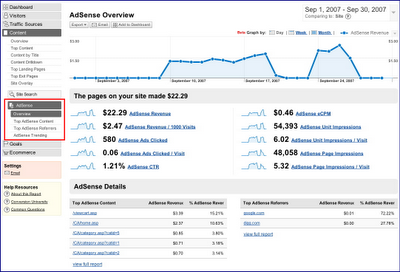

Another similarity between CFD trading and Forex trading is that the only cost of trading is the spread, as opposed to other types of trading instruments that charge commissions and other finance fees. FXCM Markets is not required to hold any financial services license or authorization in St Vincent and the Grenadines to offer its products and services. When trading CFDs, investors have significant flexibility in terms of choosing both the currencies they trade and also the increment values they want to use. The profit or loss that investors receive from these arrangements is calculated by taking the difference between the entry and exit prices and multiplying that figure by the number of CFD units. The CFD market concentrates its fluctuations on the factors that are influencing the asset that people are trading. This means that, if gold rises, we should see what took place; if a big company did something, or something else has to go down so gold could increase again, and so on.

- OANDA Corporation ULC accounts are available to anyone with a Canadian bank account.

- Likewise, when a trader purchases a CFD contract on the FTSE 100, the trader is not actually owning the stocks in the FTSE index, but rather is speculating on its underlying price.

- In our Forex Basics lessons we will introduce you to the basics of trading Forex and CFDs with BDSwiss.

- This market is also one of the largest available to investors, and it has daily trading volume of more than US$5 trillion (£3.8 trillion).

This will make for a more effective trading strategy and increase your potential to create a successful and rewarding trading career in either or both global markets in the long run. The simple answer is that none of the two markets is better than the other. In light of this, the right question to ask is what are the similarities and differences between the two markets. This way, it becomes easier to determine which market is better suited to your objectives and long-term trading plan. If you want to learn more about other combinations of currency pairs check the article about what is XAU in Forex. Trading CFDs on Forex is same as trading Forex currency pairs so you should not have any problems.

Trading FX CFDS with Fineco: what are the advantages?

Australian Unemployment data – there was a net loss of approximately 40k new jobs when a gain had been expected, but the headline unemployment rate fell to 3.4%. 1 Activation of the service is free, however a spread is applied to the exchange rate to the extent indicated in the fact sheets. A currency exchange transaction is subject to foreign exchange risk, i.e., the possibility that the purchased currency may depreciate against the reference currency.

In addition to giving significant flexibility in terms of the instruments you can trade, CFD trading also offers a wide range of contract sizes. Depending on the instrument you choose to trade, you can expect variations in the amount of the asset that makes up one CFD. For example, with metals, one standard contract is 100 ounces while with equities, one standard contract is one share. The CFD market is relatively new compared to the forex one, with a shorter history dating back to the early 1990s.

Trading Station Mobile

However, many traders are often left wondering which of the two is better. Fundamental analysis is a useful tool, which is designed to give traders a better view of the market. It also allows them to anticipate and predict future price trends to help improve success in the markets.

Enhance your Forex trading performance with leverage, choosing the most suitable margin for your trading needs. Get detailed reports in real-time, constantly updated data and essential insights to trade in an informed way. Fibonacci work on the theory that after a rate spike in either direction, the rate will return part way back to the previous price level before resuming in the original direction. Volatility describes the degree by which an exchange rate varies over time and tends to increase just prior to a rate reversal. The price of a security automatically factors in economic conditions.

Key Price Determinants

Karim holds a Bachelor’s degree in Finance & Commerce and a Master’s degree in Financial Management from the University of Cairo, and is a Certified Financial Technician . The difference between CFD trading and Forex trading is that CFD trading involves different types of contracts covering a diverse set of markets, such as indices, energy, and metals, whereas Forex offers currency trading. First, both types of trading involve a similar trade execution process. Traders can easily enter or exit the market in both rising and falling markets. Second, both CFD trades and Forex trades are executed on the same platform, using similar looking charts and pricing methods. In both cases, trades are executed in the over-the-counter market, which is run entirely electronically within a network of banks, with no physical location or central exchange.

1. Non-ownership of the Underlying Asset

2 It is possible to arrange transfers only in the currency of the account the transaction is sent from. For example, from the GBP account you can only make transfers in GBP. Trade forex and CFDs while referencing an extensive list of leading edge indicators and drawing tools. Windsor Brokers Ltd, does not accept clients from the USA, Japan and Belgium. Windsor Brokers Ltd is committed to maintain the highest standards of ethical behavior and professionalism, as well as a high level of trust and confidence, all of which are pillars of Windsor’s corporate culture. If you wish to fund your account via wire transfer, please contact your account manager or access our live chat to receive the appropriate banking details.

The trading strategy must include robust risk and money management rules and part of the plan must include a lot of practice on a demo account. Similarly, when you trade CFDs, for example, by buying a CFD contract on the FTSE 100, you’re not actually buying and owning the stocks in the FTSE exchange hence the name contract for difference. You don’t own a barrel of oil, but you merely speculate on whether the oil’s underlying price will go up or down. Forex and Contracts for Difference ("CFDs") are popular investment options for many traders across the globe. Both offer several benefits that make them attractive to people looking to succeed in the financial markets.

This market is also one of the largest available to investors, and it has daily trading volume of more than US$5 trillion (£3.8 trillion). You can have a standard contract worth 100 ounces if you are trading commodities, but if you are trading equities, then the contract will be one share. In our Forex Basics lessons we will introduce you to the basics of trading Forex and CFDs with BDSwiss.

Their response forces the value of the asset to swing towards the intrinsic value of the asset. Comparing an asset’s intrinsic value with its market value to buy or sell is the basis of fundamental analysis. Slobodan joined Windsor Brokers in 1995, having been an active trader for over a decade. At Windsor, he managed the trading desk and own account departments for 13 years. During the past ten years, he has been heading the analysis department and is responsible for preparing daily technical outlooks. In addition to this, he provides more in-depth analyses of forex, commodities and global market developments.

Cryptocurrencies have also finally started being of much more interest in the market than they were before. Forex and CFD prices are impacted by macro and micro-economic data, geo-political events and their linkages. These factors may include for example, GDP growth rates, potentially disruptive geopolitical events, employment statistics, interest rates, and balance of trade reports among others. By assessing the relative trend of these data points, a trader is essentially analysing the relative health of the country’s economy and determines the future movement of their currency. All products and services offered are dedicated to Fineco account holders.