Communication is typically done online or over the phone, making it easy and convenient. Accounts payable refers to the money owed by the business to its suppliers. Managing accounts payable involves keeping track of outstanding bills, paying bills on time, and reconciling payments. By considering these factors, you can find an outsourced bookkeeping service that will be the right fit for your business and help you manage your finances with confidence.

Our mission statement is to provide clear, consistent, and honest communication with our clients. For business owners who need more flexibility, we offer flexible options. If you need more or less reporting, we can accommodate your business needs.

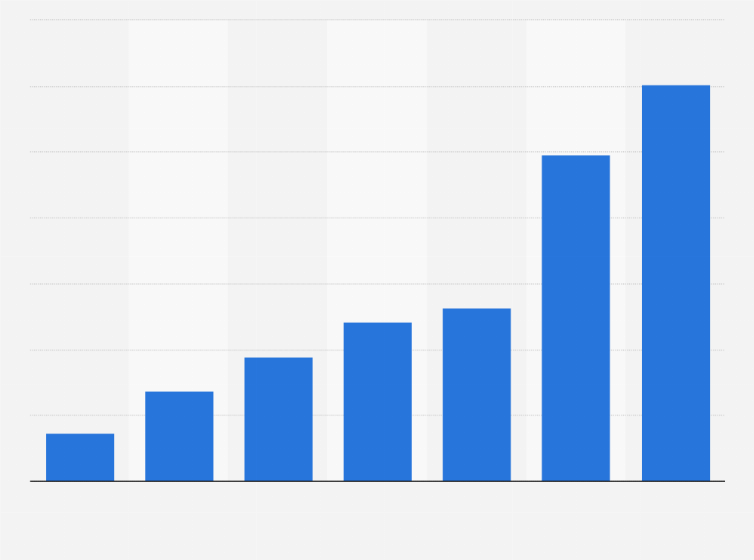

Growth & Advisory Services

Accounting Services For Small Businesses can become an integral element of your business model as you grow and expand into new markets. These services can help you save time and money while providing the peace of mind that comes from having your finances under control. You may rest easy knowing that skilled Tax Agent In Singapore are taking care of this crucial administrative task on your behalf as a result of this excellent and constantly improving service. Hiring a bookkeeping service is about more than just finding someone who can use a calculator and understand QuickBooks.

Jobs of the Week – August 16 – Buckrail

Jobs of the Week – August 16.

Posted: Wed, 16 Aug 2023 19:15:00 GMT [source]

Bookkeeping services play a vital role in maintaining accurate financial records, ensuring tax compliance, facilitating financial analysis, and supporting the growth and scalability of businesses. By outsourcing bookkeeping tasks to experienced professionals, eCommerce entrepreneurs can focus on core business operations while gaining valuable insights into their financial health. With the numerous benefits they provide, professional bookkeeping services are a smart investment for any eCommerce business.

Just need to file your taxes?

Hiring a local bookkeeper involves finding an individual or a firm that is based in the same geographic location as your business. This allows for in-person meetings and easy access to important financial records. The advantage of a local bookkeeper is that they have a better Professional bookkeeping service understanding of local regulations and can offer more personalized service. However, it can be more expensive and may not be feasible for businesses in remote areas. Bookkeepers create financial reports to provide an accurate picture of the financial health of a business.

Plenty of people believe bookkeepers’ work is primarily centered on data entry and some even mistakenly believe bookkeeping is tied to tax roles. However, true quality bookkeeping is a forward-looking accounting services-focused position, not an archival position. And for those who correlate bookkeepers with tax functions, bookkeepers are rarely even properly certified to prepare taxes or file them. Outsourcing bookkeeping tasks to a professional service can be more cost-effective than hiring an inhouse bookkeeper. You will not have to pay for employee benefits such as health insurance and retirement plans, and you will only pay for the services you need. Some bookkeeping services offer support with setting up bookkeeping software, as well as training on how to use it effectively.

#2: Avoid unnecessary mental time travel

Bookkeepers are often responsible for handling payroll and ensuring that it is done correctly and on time. It involves comparing the balance in a business’s bank account with the balance in its accounting records to ensure that they match. This process helps to identify and correct errors, as well as identify any potential fraud or theft. If you already have an accountant, consider talking to them about who they currently work with. Finding a bookkeeper who has a working relationship with your accountant can make the relationship between the three of you even stronger. Additionally, if they both use the same software, it can streamline the process and ensure that your financial data is well-organized and easy to access.

Bookkeepers at Ossisto are trained professionals with years of experience. They use best practices and follow a well-established process to ensure accuracy in bookkeeping. This can help prevent errors and ensure that your financial statements are accurate and reliable. Virtual bookkeeping is a modern, paper-free method of handling your financial records. It refers to outsourcing your bookkeeping to a professional who will manage your books and financial information through an online platform. Tax returns can be challenging for small business owners, with deadlines to meet and rules to follow.

Why Accountants are Essential to the Success of Your Business

We can help get you connected with an experienced bookkeeper through the Xero advisor directory. You can check out bookkeepers in your region and your industry in the Xero advisor directory. Make data-driven decisions to drive reader engagement, subscriptions, and campaigns. Consider whether you want to work with a sole operator, a small consultancy, or a larger company. In most cases we set this up according to normal restaurant accounting practices, but if you have a unique situation, or are part of a franchise that requires something different, we can do it.

- Bookkeeping firms that work with small businesses hire trained accountants who take full ownership of Company Secretarial Services.

- Bookkeeping firms, on the other hand, typically offer more guarantees and assurances.

- At the beginning of our work together, we’ll discuss your needs and provide a quote for the service cost.

- Accounts payable refers to the money owed by the business to its suppliers.

Not only do they ensure that books are maintained properly to avoid costly mistakes, fees, and penalties, but they can also help alert you to waste and mismanagement of supplies and inventory. All while saving you time since you will no longer need to try and perform these tasks yourself. Not to mention, having access to up-to-date financial statements instantly is a great benefit. Bookkeepers reconcile bank accounts for all of a company’s transactions, ensuring there is agreement and balance. These professionals also keep a watchful eye on the money moving into and out of your business, ensuring balances in bank accounts match up with those in accounting software.

First, we’ll hold a kickoff meeting to discuss the long-term goals and bookkeeping needs. The more we understand your needs, the better we can serve your business. At The Clem Collaborative, we take the time to understand you and your financial goals so that your investment decisions are aligned with them.

Check if there is a bookkeepers association or something similar listed in your area. You can find bookkeepers operating at all sorts of price points, and delivering all sorts of results. But there are now some very interesting pricing models that allow you to hire a consultant without taking a huge financial risk. Bookkeepers increasingly use software to take care of recurring tasks. They will help implement these sorts of technologies, often taking care of setup and training your staff. Are you juggling with keeping the books straight while managing your business?

COST OF professional BOOKKEEPING SERVICES

They may have varying levels of experience and skill, and their rates can be more affordable than those of bookkeeping firms. However, there is always a risk that the bookkeeper may be unavailable if they need to take time off or are unable to continue providing their services. This type of service involves the bookkeeper entering all the financial transactions into a software system, ensuring accuracy and completeness of the information. It involves calculating gross pay, withholding taxes and other deductions, and issuing net pay to employees. Payroll also involves tracking vacation time, sick leave, and other benefits.

- A controller reviews the bookkeeper’s ledger for accuracy while also maintaining the integrity of the accounting data file in the future so that adjustments can’t be made without approval.

- Bookkeeping services help eCommerce businesses track incoming revenue and outgoing expenses, allowing them to manage cash flow effectively.

- Many people use their savings accounts either not at all, or to hold small amounts or to hold their sales tax or other payments due.

- Bookkeepers increasingly use software to take care of recurring tasks.

This service helps businesses to reconcile their bank statements with the financial records in their software system, ensuring that there are no discrepancies and that the books are up-to-date. Are you looking for a bookkeeper who is also a trusted advisor, a trainer, or just someone to perform the tasks for you? Consider what type of relationship you want with your bookkeeper, as this will help you find and hire professional bookkeeping service that is the right fit for your needs. If you are running a small business, you should understand the requirement of proper bookkeeping for your company. Your needs about Bookkeeping Services In Singapore may be minimal for the first two or three weeks of the month, but will likely increase to full-time by the end of the month and, likely, the end of the year.

Professional bookkeepers have the expertise to handle growing financial data, ensuring that all transactions are accurately recorded and organized. By maintaining clear financial records, bookkeepers provide a solid foundation for future growth, allowing businesses to make informed decisions and attract potential investors or partners. One of the primary benefits of bookkeeping services is the maintenance of accurate financial records.

Now it’s time to take your business to the next level and ensure its future success by putting an accounting team in place. Allow them to give you the advantage of maximized efficiency of your business income and expenses while holding your employees accountable and minimizing exposure to various financial and audit risks. If you care about the future of your company, hire a virtual bookkeeping service today. You see, bookkeeping services implement—and maintain—a consistent financial process that strengthens the health of your company and helps to create and encourage uniformity in tracking, paying, and reporting. The value of this is immeasurable as it insulates your business from many costly and dangerous risks. And this is where we bring in the third prong of the bookkeeping service, the controller.